Chris Hicks doesn't understand why taxes are again on the rise in Montgomery County.

Taxes across the county went up 1.5 percent on July 1 with the intention of helping to fund school improvements and erasing debt.

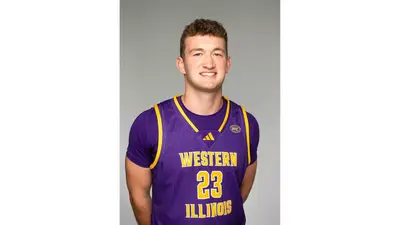

“I don’t think anyone would want to or should have to pay more taxes,” Hicks, a Republican running for a Senate seat from the 48th District, told the West Central Reporter. “I think we all can agree taxpayers across the state are already being forced to pay more than their fair share.”

According to the State Journal-Register, the increase comes from a 1 percent sales tax increase and a public safety tax of .5 percent. The latter is expected to generate up to $1.4 million a year, which would in part go to improvements at the jail and sheriff’s department.

The increase raises taxes to 7.75 percent from 6.25 in rural Montgomery County, while urban areas like Litchfield and the Nokomis and Hillsboro business districts pay 8.75 percent instead of 7.25 percent.

The push for the increase in the name of school improvements was initiated by the Hillsboro School District, and Hicks argues the tax hike seems like just another way bureaucrats misstep.

“They’ve been trying to get more money for Hillsboro for a while now, and I think this is just another step in that effort,” Hicks said, pointing out that Hillsboro voters last March rejected a $34.5 million bond referendum that called for demolishing the nearly century-old area high school and building a new structure.

“If taxpayers really want to be heard on these kinds of issues they will need to stay vigilant and turn out at the polls to raise their voices,” Hicks added.

Hicks has made taking a stand against new taxes a primary rung of his campaign platform. He was adamantly against the now-approved state budget measure to raise $5.4 billion through personal and corporate tax hikes. On his Facebook page, Hicks attacked the increase.

"Today the HOUSE voted 71-42 to override the veto by Governor Bruce Rauner," he posted. "Unfortunately this means individuals will pay 4.95% instead of 3.75% on their income tax. The corporate and business rate jumps from 5.25% to 7%. The budget is retroactive to July 1st, which was the beginning of the fiscal year, and the 32% tax hike will now be permanent! Illinois taxpayers are once again kicked in the teeth!"

Alerts Sign-up

Alerts Sign-up